Best Savings Accounts

The finest digital savings accounts are compatible with your financial objectives and routines. At a bare minimum, this requires locating an account with a respectable rate of return, low maintenance costs, and low required opening deposits. Here are the best savings accounts to consider:

Last Updated February 2026

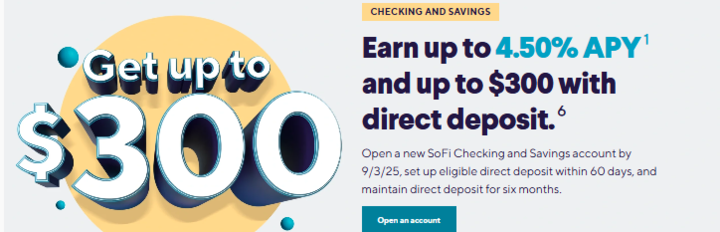

Sofi Savings accounts

AMEX

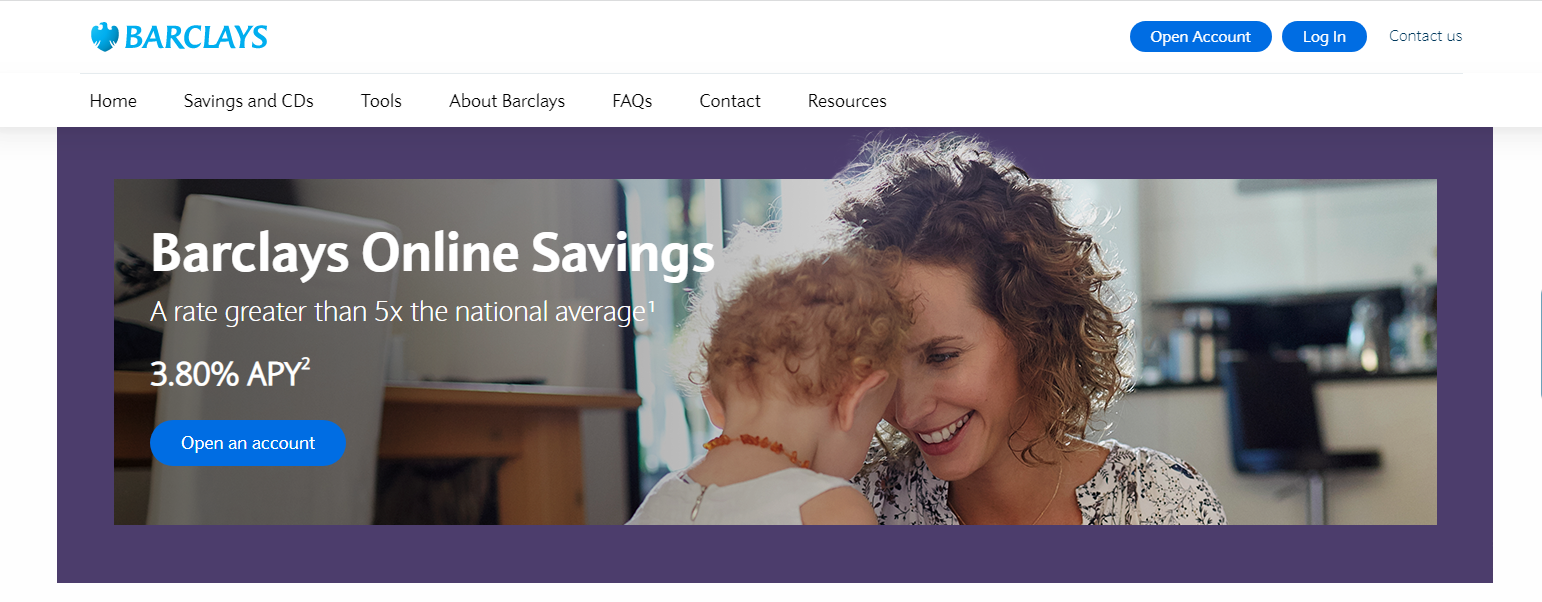

Barclays

Chime

CIT Bank

Citi Savings

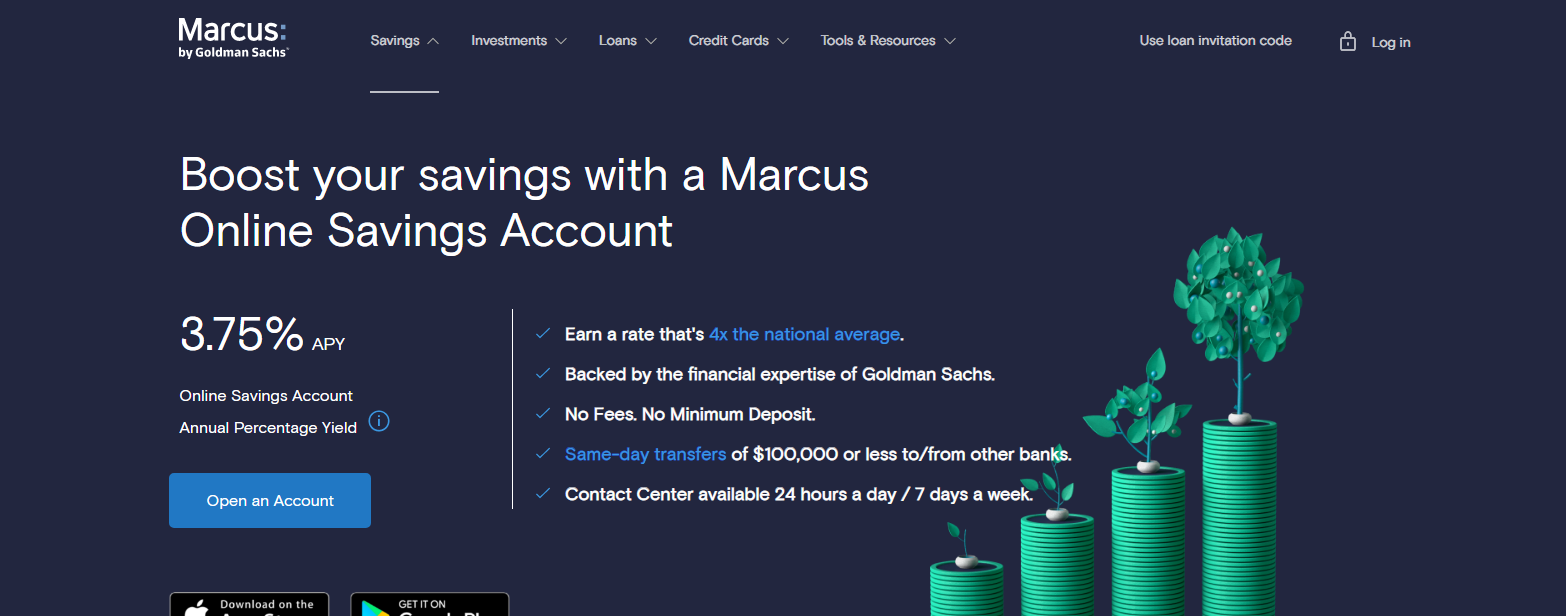

Marcus

Quontic

UFB-Direct

OUR RATINGS

Our Research Has Helped Millions of Users To Get Lowest Prices From Leading Providers.

Step 1: COMPARE

Compare the best brands side by side

Step 2: CONNECT

Work only with suppliers you choose

STEP 3: SAVE

Compare quotes to save money

- Best For - Savers seeking a high-yield savings option with fee-free digital banking

- Rating - 4.6/5

You may benefit from the SoFi Savings Account if you want to grow your money faster without worrying about fees. SoFi Bank, N.A. offers up to 3.80% APY² on savings balances (including Vaults) when you set up qualifying direct deposit or meet the required deposit threshold during the 30-day Evaluation Period.

There are no minimum balance requirements, and your money is FDIC insured up to $250,000, with access to up to $3M in additional FDIC insurance through the SoFi Insured Deposit Program⁴. Users can manage savings goals through Vaults and monitor their interest growth via the SoFi app. Disclosures 2. APY accurate as of 1/24/25 and subject to change. Requires eligible direct deposit or $5,000+ in qualifying deposits during the 30-day Evaluation Period. 3. SoFi Bank does not charge account, service, or maintenance fees. Outgoing wire fees may apply. 4. SoFi Bank is a member FDIC and provides insurance up to $250,000. Additional FDIC insurance up to $3M is available via the SoFi Insured Deposit Program

Pros

Cons

- Best For - Anyone seeking an online savings account with little hassle and a respectable rate of return.

- Monthly Fees - Free.

- ATM Card - Not available.

- Rating - 4.2/5.

AMEX is a financial services company best known for its credit cards. Similarly, the company also provides other banking options, such as online checking and savings accounts. As an online-only bank, Amex Bank cannot provide its clients with branch locations for in-person assistance. However, it does provide phone help that is available 24/7.

Automatic deposits from a checking account to a savings account may be easily set up. But, the key to automation is hidden in the fine print of their website. So far, AMEX has placed more emphasis on the automated setup process.

Pros

Cons

- Best For - Individuals who do not need checking services or desire a minimal amount on their savings or CDs to get a high-interest rate.

- Minimum Deposit - $0

- APY - 3.80%

- Rating - 4.5/5

Barclays is an online bank that offers high-interest savings accounts and certificates of Deposit. Barclays does not provide a checking account; thus, if you want access to your funds, you must move them to another financial institution.

Telephone and real-time chat support for customers is offered every day of the week. You may reach a representative Monday through Friday, 8 a.m. to 8 p.m. EST. The BBB has given Barclays an A+.

Pros

Cons

- Best For - Clients paid by direct deposit, rarely deposit cash and are interested in earning the most return possible on their savings accounts.

- APY - 2.0%

- Monthly Fee - $0

- Rating - 4.5/5

Chime is a digital banking platform that collaborates with two banks to give customers access to savings accounts. It's not like your local bank, but your money is still secure in its accounts since the FDIC backs them. Chime allows you to round up transactions to the next dollar and keep the difference and there are no monthly or overdraft fees. However, cash deposits may be expensive.

Pros

Cons

- Best For - Users familiar with banking online would want a competitive annual percentage yield.

- APY - 4.20% with a minimum of $100 to qualify.

- ATM Fees - Up to $30.

- Rating - 4.0/5.

CIT Bank offers its customers three savings accounts: the Savings Builder, the Savings Link and the Platinum Savings account. There is no monthly maintenance charge for the three accounts; the smallest initial investment is just $100.

Those with larger balances in their savings Builder accounts are eligible for a greater interest rate. Earning the best rate requires a minimum monthly deposit of $0 or a minimum account balance of $25,000. There are no minimum balance requirements for the Savings Connect or the Platinum Savings account; both provide a competitive interest rate.

Pros

Cons

- Best For - Citizens in the locations where Citi offers its high-yield savings account and desire access to a vast network of accessible ATMs.

- Monthly Fee - $12.00 Waived with a $1,500 minimum balance.

- Rating - 4.3/5.

Your interest rate may vary depending on your location and the specific savings account you create with Citibank. Regarding savings accounts, Citibank's Citi Accelerate Savings account has the highest interest rates. You may open an account with one of the finest high-yield savings accounts if you cannot get a Citi Accelerate Savings account due to where you reside.

Pros

Cons

- APY - 3.75%

- Rating - 4.7/5

Marcus savings account is a popular online savings account offered by Goldman Sachs Bank USA. This account is known for its competitive interest rates, which can be higher than the national average. Customers can open an account with no minimum deposit requirement and no fees associated with the account. The account also allows for easy access to funds through online transfers and mobile banking. Marcus savings account is FDIC-insured, meaning deposits are insured up to $250,000 per depositor, per account ownership category. Marcus doesn't limit the number of transfers or withdrawals taken from your Marcus savings account.

Pros

Cons

- APY - up to 1.10% on all balance tiers.

- Minimum Deposit Requirements - $100/

- Rating - 5/5

Qountic is a digital banking platform that offers a savings account with competitive interest rates. The Qountic savings account is designed to help customers grow their savings easily and conveniently. With the Qountic savings account, customers can enjoy no monthly fees, minimum balance requirements or maximum balance limits. Customers can earn interest on their savings, which are compounded daily and paid monthly. The interest rates offered by Qountic are typically higher than those offered by traditional banks, which means customers can earn more on their savings.

Pros

Cons

- Best For - Those looking for simple, straightforward savings account with a high-interest rate, no fees or minimum balance requirements.

- APY - Up to 5.15%

- Minimum Balance - None

- Monthly Fee - None

- Rating - 4.6/5

UFB Direct is an online bank that offers a variety of financial products, including savings accounts. Their savings account is the UFB Direct High Yield Savings Account, which provides a competitive interest rate much higher than the national average. No monthly maintenance fees or minimum balance requirements make it an ideal option for those looking to save money without worrying about additional charges.

UFB Direct's High Yield Savings Account has several features, such as online and mobile banking, free bill pays and eStatements. The account is FDIC-insured up to $250,000 per depositor, so customers can rest assured that their funds are safe and secure.

Pros

Cons

Sofi Savings accounts

AMEX

Barclays

Chime

CIT Bank

Citi Savings

Marcus

Quontic

UFB-Direct

OUR RATINGS

Our Research Has Helped Millions of Users To Get Lowest Prices From Leading Providers.

Step 1: COMPARE

Compare the best brands side by side

Step 2: CONNECT

Work only with suppliers you choose

STEP 3: SAVE

Compare quotes to save money