Best Debt Relief Companies

Discover a new path to financial freedom with our premier debt relief companies. Our dedicated team of experts understands the challenges that come with overwhelming debt and is committed to providing personalized solutions tailored to your unique situation. With our proven strategies and years of experience, we have helped countless individuals and families break free from the burden of debt, offering expert guidance, customized plans, and ethical practices. Trust us to deliver effective results, empower you with ongoing support, and pave the way for a brighter financial future. Take the first step today and experience the relief you deserve.

Last Updated December 2025

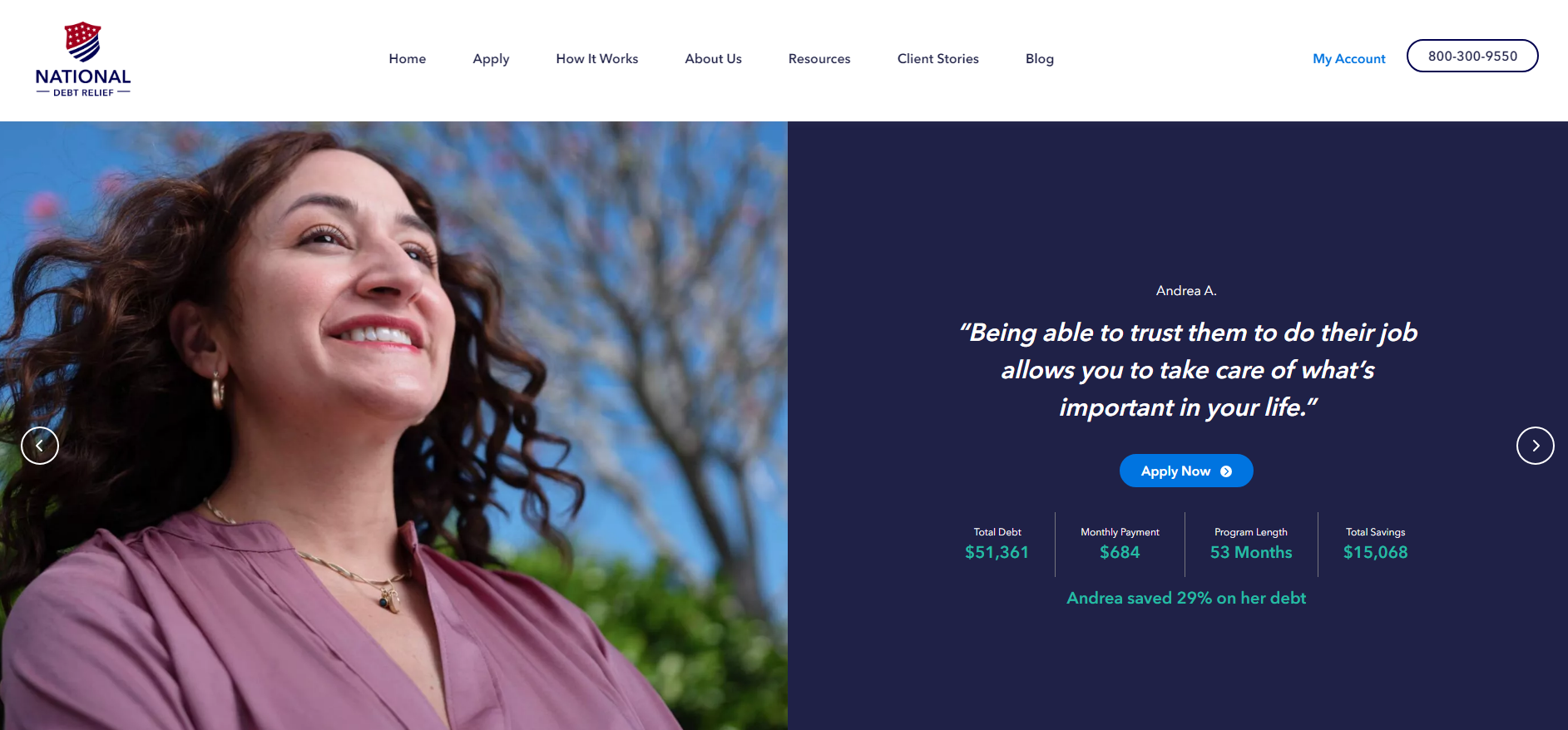

National Debt Relief

Accredited Debt Relief

Credit Saint Debt Relief

Optimal Debt Solutions

DebtMD

TurboDebt

TotalDebtRelief.net

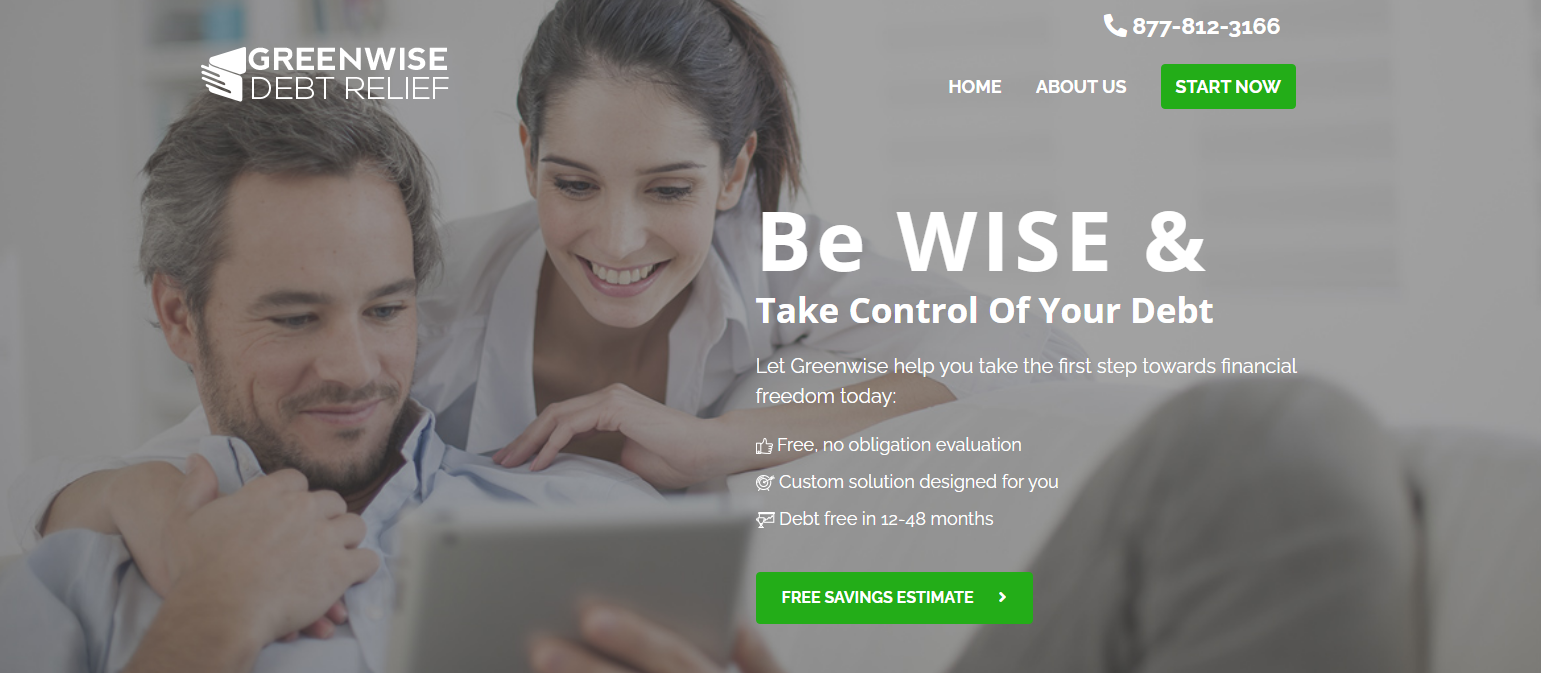

Greenwise Debt Relief

Simple Debt Solutions

New Era Debt Solutions

OUR RATINGS

Our Research Has Helped Millions of Users To Get Lowest Prices From Leading Providers.

Step 1: COMPARE

Compare the best brands side by side

Step 2: CONNECT

Work only with suppliers you choose

STEP 3: SAVE

Compare quotes to save money

- Best For - Individuals seeking high client satisfaction and comprehensive credit counseling

- Rating - 4.7/5

NationalDebtRelief.com distinguishes itself in the debt relief industry by offering flexible termination options and an extensive creditor negotiation process. With a commitment to transparent pricing and a user-friendly platform, they strive to provide effective debt relief solutions for their clients.

One of the notable advantages of NationalDebtRelief.com is its affordable and clear pricing structure. Unlike many competitors, they offer transparent pricing that helps clients understand the costs involved in their debt relief journey. Clients have the flexibility to terminate their memberships at any time with no further charges, giving them control over their financial decisions.

The company provides multiple avenues for customer support, ensuring that clients can easily access assistance. Their dedicated customer care team is available via voice calls, online chat, and email, allowing clients to seek guidance and stay informed about their debt relief progress.

NationalDebtRelief.com offers a comprehensive approach to debt relief, including creditor negotiation services. Their skilled negotiators work on behalf of clients to engage with creditors and develop customized settlement plans. By aiming to reduce debt amounts and negotiate favorable terms, NationalDebtRelief.com strives to provide effective solutions that align with each client's financial situation.

Pros

Cons

- Best For - Individuals seeking proven success and holistic debt solutions

- Rating - 4.6/5

AccreditedDebtRelief.com stands out as a reputable and experienced debt relief company offering a comprehensive range of debt management solutions. With a commitment to client satisfaction, a strong track record, and a variety of services, they strive to provide effective debt relief options for individuals in need.

One of the notable advantages of AccreditedDebtRelief.com is their reputation in the industry. With years of experience, they have established themselves as a trusted provider of debt relief services. Their expertise and knowledge allow them to navigate complex debt situations and provide tailored solutions that suit each client's unique needs.

The company offers a wide range of debt management solutions. From debt consolidation to debt settlement, AccreditedDebtRelief.com provides a variety of options to address different types of debt. This flexibility ensures that clients can find a solution that aligns with their financial circumstances and goals.

AccreditedDebtRelief.com is dedicated to client satisfaction. Their team of professionals is committed to delivering exceptional customer service and support throughout the debt relief process. Clients can rely on their expertise and guidance to navigate the challenges of managing debt and work towards a brighter financial future.

Pros

Cons

- Best For - Individuals looking to resolve debt while improving their credit score through personalized credit repair solutions

- Rating - 4.5/5

Credit Saint focuses on credit restoration while also helping clients address underlying debt issues. With a strong reputation in the credit repair space, Credit Saint disputes inaccurate, outdated, or unverifiable items on credit reports—empowering clients to rebuild financial health and potentially access better debt resolution opportunities.

The service includes tailored credit audits, dispute tracking, and one-on-one financial consultations. While not a direct debt settlement provider, Credit Saint supports consumers who are working toward long-term debt and credit recovery.

Pros

Cons

- Best For - Individuals and businesses looking for tailored debt relief solutions and expert financial guidance

- Rating - 4.5/5

OptimalDebt Solutions offers an efficient approach to debt relief that caters to clients struggling to manage overwhelming debt. With a team of experienced financial experts, this company has the resources to develop personalized strategies for reducing debt burdens. OptimalDebt Solutions focuses on negotiating with creditors to lower the total amount owed, making it a viable choice for individuals and businesses seeking financial relief and a clear path toward financial freedom.

Debt can quickly become unmanageable due to high interest rates, unexpected financial hardships, or prolonged economic challenges. OptimalDebt Solutions works directly with creditors, aiming to reduce the principal balances, interest rates, and fees to create a more affordable payment plan for each client. The company’s experts ensure that clients are fully informed throughout the process, helping them regain control of their financial lives and work toward debt elimination.

Pros

Cons

- Best For - Individuals looking for a platform that connects them with trusted debt relief professionals for tailored financial solutions

- Rating - 4.6/5

DebtMD offers a unique approach to debt relief by acting as a bridge between individuals struggling with debt and a network of reputable financial experts. The platform specializes in matching users with the right services, including debt settlement, credit counseling, and consolidation programs, based on their specific needs and financial situations. DebtMD is an excellent choice for those seeking customized debt relief options with expert guidance.

DebtMD simplifies the debt relief process by providing personalized recommendations and connecting users with certified professionals. The platform ensures that every client receives access to the resources they need to reduce debt, improve financial literacy, and rebuild their financial stability. DebtMD is committed to empowering clients with tools and support to take control of their financial future.

Pros

Cons

- Best For - Individuals struggling with unmanageable debt who need personalized solutions and professional guidance

- Rating - 4.5/5

TurboDebt offers debt relief services designed to help individuals regain control of their finances through customized solutions. This company specializes in debt settlement, working directly with creditors to negotiate lower balances and create program payments. TurboDebt focuses on simplifying the debt relief process, making it an excellent choice for those overwhelmed by their financial obligations.

Unmanageable debt can be a significant source of stress, but TurboDebt provides a clear and supportive path to financial recovery. With an experienced team of financial professionals, the company assesses each client’s unique situation and develops tailored strategies to reduce their debt burden. TurboDebt also offers educational resources to help clients build healthier financial habits and prevent future financial distress.

Pros

Cons

- Best For - Individuals seeking comprehensive solutions to manage and reduce overwhelming debt

- Rating - 4.0/5

TotalDebtRelief offers tailored debt relief solutions designed to help individuals regain financial stability. By assessing each client's unique financial situation, TotalDebtRelief.net is able to propose personalized plans that may include debt consolidation, settlement, and counseling services.

Pros

Cons

- Best For - Individuals seeking effective debt relief solutions

- Rating - 4.4/5

If you're burdened by debt and searching for a solution, GreenwiseDebtRelief.com offers a comprehensive approach to help you regain your financial footing. GreenwiseDebtRelief.com specializes in providing individuals with the tools and guidance needed to overcome debt challenges.

With a team of experienced professionals, customized solutions, and a commitment to ongoing support, they are well-equipped to help you take control of your financial situation. However, it's crucial to consider the costs associated with debt relief services and be aware of potential availability limitations in your area.

Pros

Cons

- Best for - Individuals seeking affordable and accessible debt relief services

- Rating - 4.4/5

SimpleDebtSolutions.com stands out among debt relief platforms by offering a user-friendly interface, personalized support, and flexible payment options. With a commitment to transparency and comprehensive debt management solutions, they strive to provide effective debt relief services for their clients.

One of the notable advantages of SimpleDebtSolutions.com is its user-friendly platform. The intuitive interface makes it easy for clients to navigate through the various features and access the necessary tools for managing their debts. With a clear and straightforward layout, clients can stay organized and informed about their debt relief progress.

The company provides personalized support to clients, understanding that each individual's financial situation is unique. Their dedicated team is readily available to offer guidance, answer questions, and provide assistance throughout the debt relief process. Whether through voice calls, online chat, or email, clients can rely on SimpleDebtSolutions.com to provide the support they need.

SimpleDebtSolutions.com offers flexible payment options, allowing clients to choose a plan that suits their financial capabilities. With the understanding that everyone's circumstances differ, they provide customizable payment plans that align with individual budgets. This flexibility empowers clients to manage their debts effectively without feeling overwhelmed by rigid payment structures.

Pros

Cons

- Best for - Individuals seeking strategic and personalized debt reduction strategies

- Rating - 4.5/5

NewEraDebtSolutions.com stands out as a debt relief provider by offering comprehensive services that prioritize financial education and long-term solutions. With a commitment to transparency, personalized support, and effective debt management strategies, they strive to provide clients with the tools and knowledge to overcome their financial challenges.

One of the notable advantages of NewEraDebtSolutions.com is their emphasis on financial education. They understand that addressing debt goes beyond mere settlement or negotiation. By providing clients with educational resources and guidance, they empower individuals to make informed financial decisions and develop sustainable money management habits.

The company offers personalized support throughout the debt relief process. Their dedicated team of experts is readily available to address client concerns, answer questions, and provide guidance based on individual circumstances. Whether through voice calls, online chat, or email, clients can rely on NewEraDebtSolutions.com for reliable and responsive support.

NewEraDebtSolutions.com focuses on delivering long-term solutions. They go beyond debt settlement by working with clients to develop personalized plans that address the root causes of their financial challenges. This approach aims to provide lasting results and equip clients with the tools to maintain a healthy financial future.

Pros

Cons

National Debt Relief

Accredited Debt Relief

Credit Saint Debt Relief

Optimal Debt Solutions

DebtMD

TurboDebt

TotalDebtRelief.net

Greenwise Debt Relief

Simple Debt Solutions

New Era Debt Solutions

OUR RATINGS

Our Research Has Helped Millions of Users To Get Lowest Prices From Leading Providers.

Step 1: COMPARE

Compare the best brands side by side

Step 2: CONNECT

Work only with suppliers you choose

STEP 3: SAVE

Compare quotes to save money