Best Credit Help Services

Credit Help Services systems can benefit your business in many ways, with a number of important features and functions. With COVID-19 constantly changing the rules of the game, the features offered by the latest Credit Help Services systems can keep you ahead of the competition, so look out for special New Year deals and make sure your business is ready for whatever Credit Help Services has in store.

Last Updated December 2025

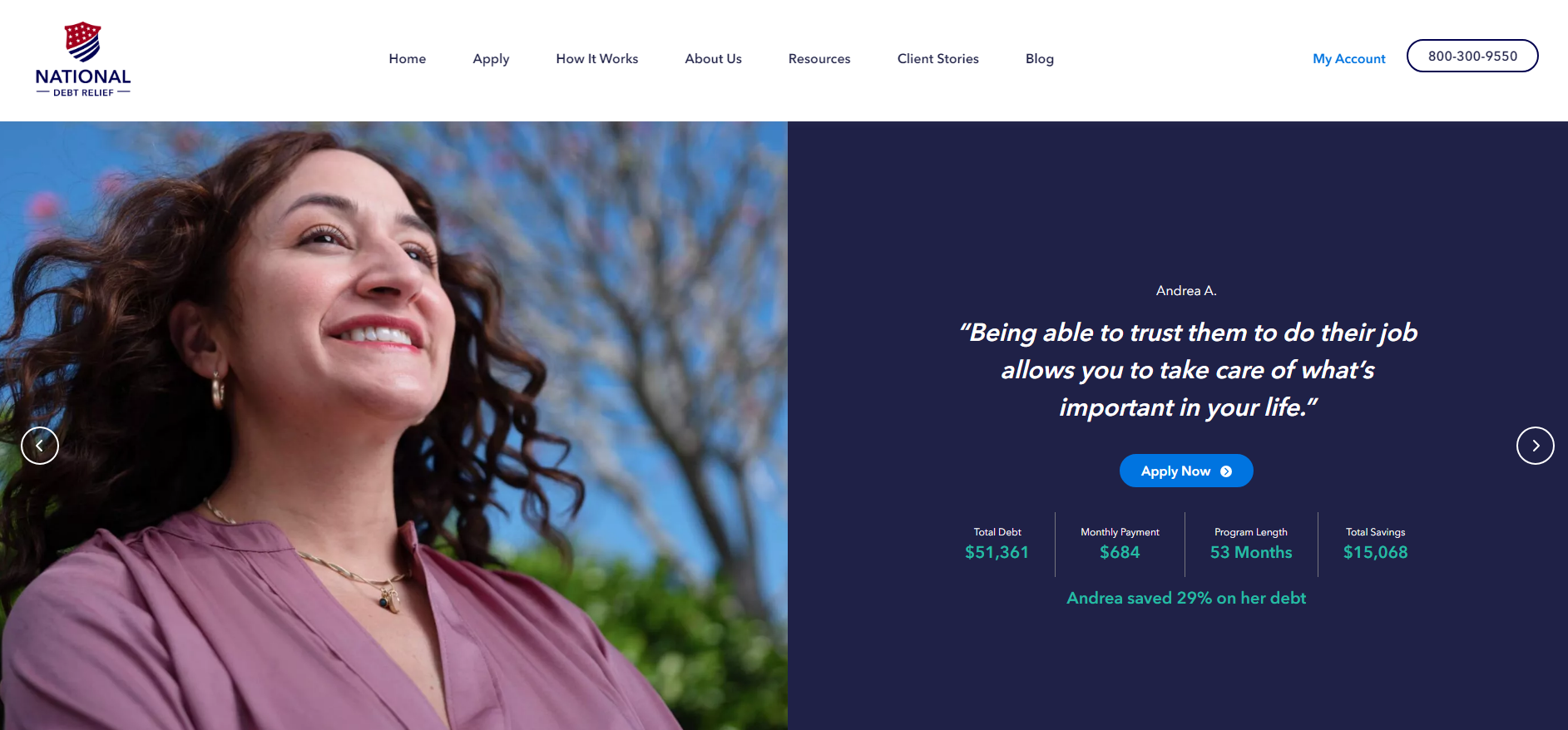

NationalDebt Relief

Accredited Debt Relief

Credit Saint

The Credit Pros

Optimal Debt Solutions

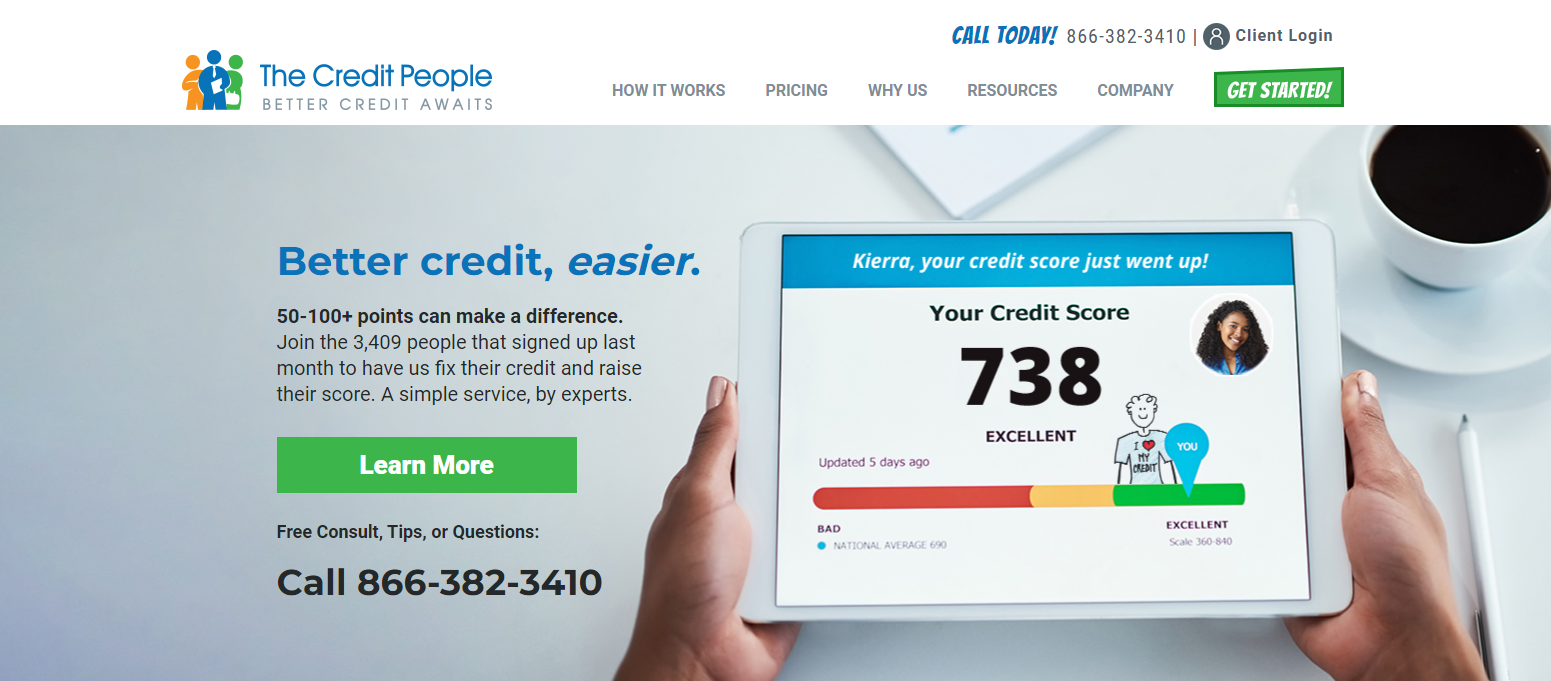

The Credit People

Safeport

Nevly

Sky Blue

OUR RATINGS

Our Research Has Helped Millions of Users To Get Lowest Prices From Leading Providers.

Step 1: COMPARE

Compare the best brands side by side

Step 2: CONNECT

Work only with suppliers you choose

STEP 3: SAVE

Compare quotes to save money

- Best For - Individuals seeking effective credit help services and debt settlement

- Rating - 4.2/5

You may benefit from National Debt Relief's credit help services if you are facing challenges with overwhelming debt. This credit assistance firm specializes in efficient debt settlement, employing experienced professionals to navigate the complexities of credit challenges. With a focus on assisting individuals in financial distress, National Debt Relief brings over a decade of expertise in debt settlement and consumer advocacy.

Financial difficulties often arise from accumulated debt, and National Debt Relief's team understands the intricacies of negotiating with creditors to achieve favorable settlements. They work tirelessly to help you regain control of your finances by customizing plans to suit your unique needs.

Pros

Cons

- Best For - Individuals seeking proven success and holistic debt solutions

- Rating - 4.6/5

AccreditedDebtRelief.com stands out as a reputable and experienced debt relief company offering a comprehensive range of debt management solutions. With a commitment to client satisfaction, a strong track record, and a variety of services, they strive to provide effective debt relief options for individuals in need.

One of the notable advantages of AccreditedDebtRelief.com is their reputation in the industry. With years of experience, they have established themselves as a trusted provider of debt relief services. Their expertise and knowledge allow them to navigate complex debt situations and provide tailored solutions that suit each client's unique needs.

The company offers a wide range of debt management solutions. From debt consolidation to debt settlement, AccreditedDebtRelief.com provides a variety of options to address different types of debt. This flexibility ensures that clients can find a solution that aligns with their financial circumstances and goals.

AccreditedDebtRelief.com is dedicated to client satisfaction. Their team of professionals is committed to delivering exceptional customer service and support throughout the debt relief process. Clients can rely on their expertise and guidance to navigate the challenges of managing debt and work towards a brighter financial future.

Pros

Cons

- Best For - Comprehensive credit repair solutions

- Rating - 5/5

You may benefit from Credit Saint's credit repair services if you are facing challenges in improving a low credit score. This credit repair company boasts a stellar reputation, supported by over 12,000 positive reviews on Better Business Bureau and a 5-star rating on Google. Credit Saint employs seasoned experts to contest credit score mistakes efficiently, ensuring a comprehensive approach to credit restoration.

Credit bureaus often utilize incorrect, obsolete, or unreliable data in credit score computations. Credit Saint's team will meticulously examine your credit report, identifying errors and disputing unfavorable entries with the credit reporting agencies and your creditors to help elevate your credit score.

Pros

Cons

- Best For - Individuals seeking top-notch credit repair services

- Rating - 4.9/5

You may benefit from The Credit Pros' credit repair services if you face challenges in improving a low credit score. This credit repair firm employs skilled professionals to contest credit score inaccuracies effectively. With over 20 years of combined expertise in credit restoration and consumer advocacy, these experts are equipped to assist you in navigating your financial situation.

The team at The Credit Pros diligently examines your credit report, identifies errors, and disputes any unfavorable entries with the credit reporting agencies and your creditors, aiming to enhance your credit score.

Pros

Cons

- Best For - Individuals and businesses looking for tailored debt relief solutions and expert financial guidance

- Rating - 4.5/5

OptimalDebt Solutions offers an efficient approach to debt relief that caters to clients struggling to manage overwhelming debt. With a team of experienced financial experts, this company has the resources to develop personalized strategies for reducing debt burdens. OptimalDebt Solutions focuses on negotiating with creditors to lower the total amount owed, making it a viable choice for individuals and businesses seeking financial relief and a clear path toward financial freedom.

Debt can quickly become unmanageable due to high interest rates, unexpected financial hardships, or prolonged economic challenges. OptimalDebt Solutions works directly with creditors, aiming to reduce the principal balances, interest rates, and fees to create a more affordable payment plan for each client. The company’s experts ensure that clients are fully informed throughout the process, helping them regain control of their financial lives and work toward debt elimination.

Pros

Cons

- Best For - Cost-effective credit repair services

- Rating - 4.2/5

The company stands out from the competition due to its inexpensive initiation costs. Unlike competing credit repair businesses, The Credit People only charge $19 to sign up and see your credit report. Once your account is set up, you can pay $79 each month until you reach your goals or pay $419 upfront for a six-month plan.

Using The Credit People's user-friendly online dashboard, you can keep tabs on any changes made to your credit report or credit score by any of the three major credit reporting agencies. Similarly, you may contact customer care if you have any queries or want to keep tabs on any pending issues.

Pros

Cons

- Best For - Individuals seeking professional credit repair and debt settlement services

- Rating - 4.8/5

SafePort Law's credit repair services cater to individuals facing challenges with a low credit score. With an admirable rating on Better Business Bureau, this company distinguishes itself by offering top-tier legal counsel and credit repair expertise. The seasoned legal professionals, boasting over 15 years of experience, diligently work to rectify credit score mistakes and advocate for consumers.

Pros

Cons

- Best For - Individuals seeking professional credit repair and financial guidance

- Rating - 4/5

Nevly provides valuable credit help services for individuals looking to repair their credit and gain financial independence. With experienced professionals, tailored credit repair plans, and a focus on financial education and support, they offer a solid path to improving your credit and overall financial health.

Navigating the complexities of credit repair and financial management can be challenging, but Nevly offers comprehensive credit help services to assist you on your journey to better credit and financial stability.

They offer a range of benefits for those seeking to improve their credit and financial well-being.

Pros

Cons

- Best For - Affordable credit repair options

- Rating - 4.0/5

Sky Blue Credit help has been in business for over thirty years. The company offers a unique and affordable single credit-help service plan that entails all the necessary support to clean up a credit report.

Sky Blue service packages do not require upgrades to expensive plans. The company charges a one-time set-up fee of $79 and a monthly subscription of $79, giving clients access to detailed credit-report analysis and customized dispute letters.

Sky Blue offers a 50% discount to one member of a couple that has subscribed together. The company has a 90-days refund policy. Clients unsatisfied with the services provided can claim a refund within ninety days.

Sky Blue allows customers to pause their subscriptions online. You will not get charged the monthly subscription fees during the paused period. The flexibility of pausing and resuming accounts helps clients save on frequent start-up fees.

Pros

Cons

NationalDebt Relief

Accredited Debt Relief

Credit Saint

The Credit Pros

Optimal Debt Solutions

The Credit People

Safeport

Nevly

Sky Blue

OUR RATINGS

Our Research Has Helped Millions of Users To Get Lowest Prices From Leading Providers.

Step 1: COMPARE

Compare the best brands side by side

Step 2: CONNECT

Work only with suppliers you choose

STEP 3: SAVE

Compare quotes to save money