CIT Bank

CIT Bank offers a checking account to give customers easy access to their funds while providing competitive interest rates. The account has no monthly maintenance fees, minimum balance requirements, or overdraft fees, making it an attractive option for those looking for a simple and hassle-free checking account.

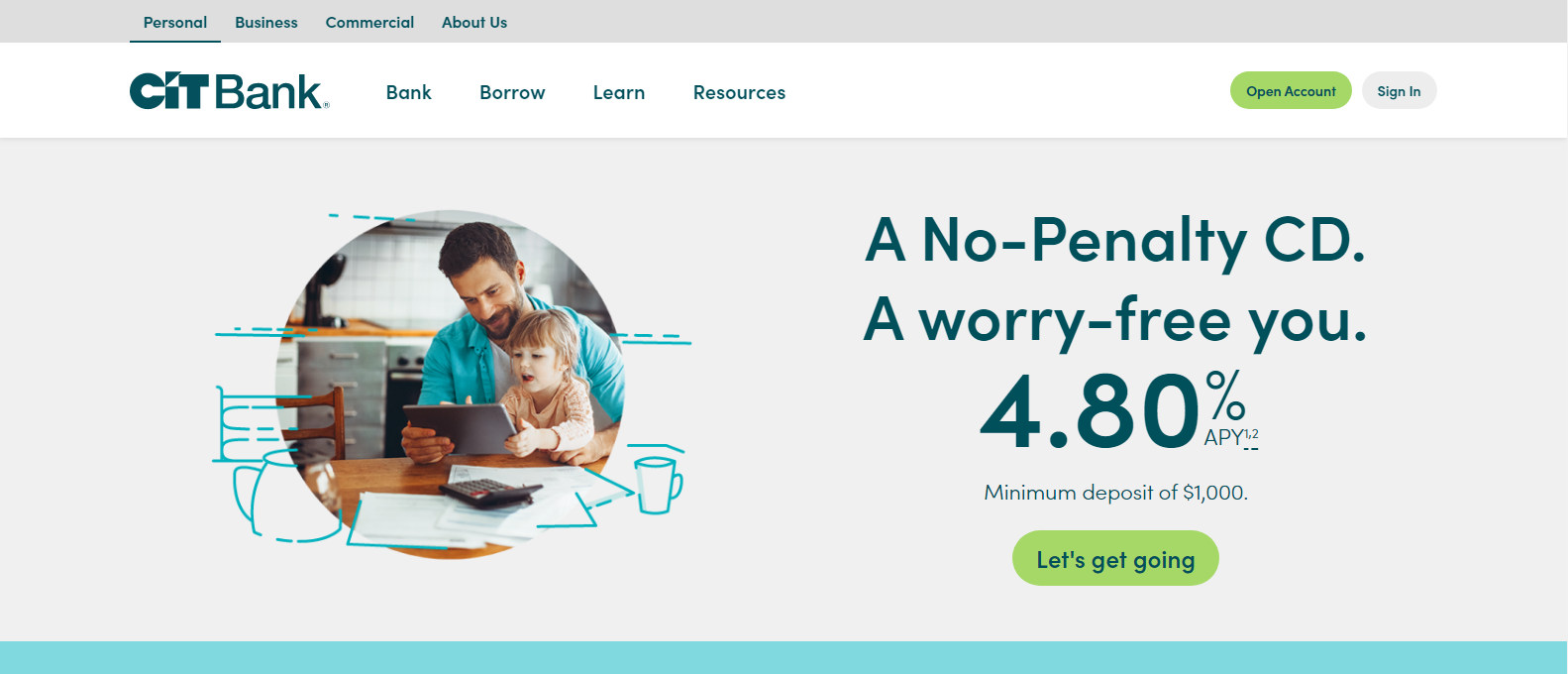

CIT Bank Review

CIT Bank offers a checking account to give customers easy access to their funds while providing competitive interest rates. The account has no monthly maintenance fees, minimum balance requirements, or overdraft fees, making it an attractive option for those looking for a simple and hassle-free checking account.

With the CIT Bank checking account, customers can access their funds using their CIT Bank debit card or online banking platform. The account also comes with free online bill pay and mobile banking, allowing customers to manage their finances on the go.

One unique feature of the CIT Bank checking account is its tiered interest rates, which means the interest rate increases as the account balance grows. This makes the

account an excellent option for those who keep a higher balance in their checking account and want to earn more interest on their money.

Pros

Cons

Best Business Checking Accounts Providers