Best Auto Insurance Plans

The most reliable car insurers will tailor their services to your specific budget, driving history, and other factors to provide you with the best possible quote. Knowing what you need and doing some comparison shopping for car insurance will help you find the policy that best fits your circumstances. Here are the best companies to consider:

Last Updated December 2025

Statefarm Auto Insurance

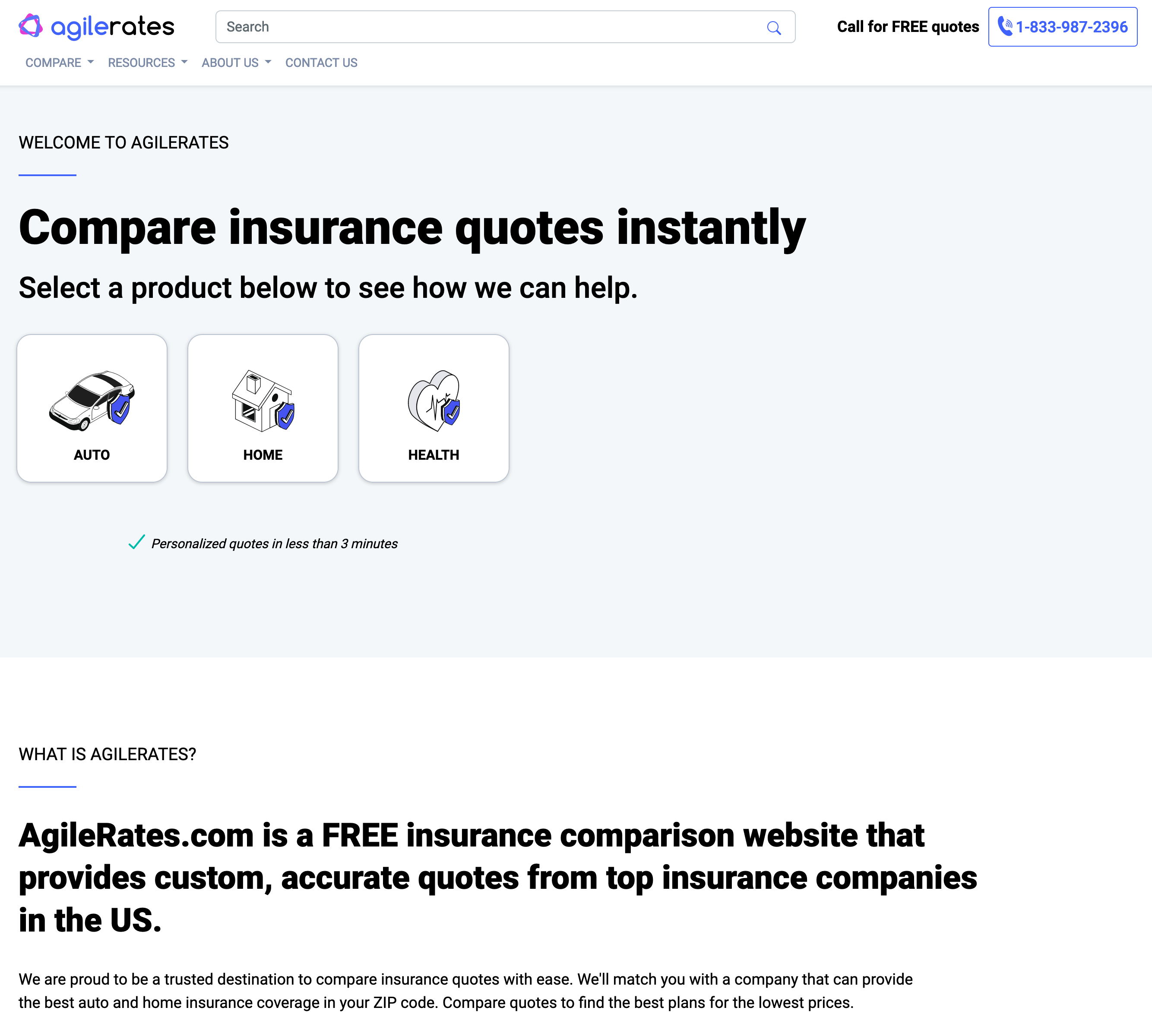

AgileRates

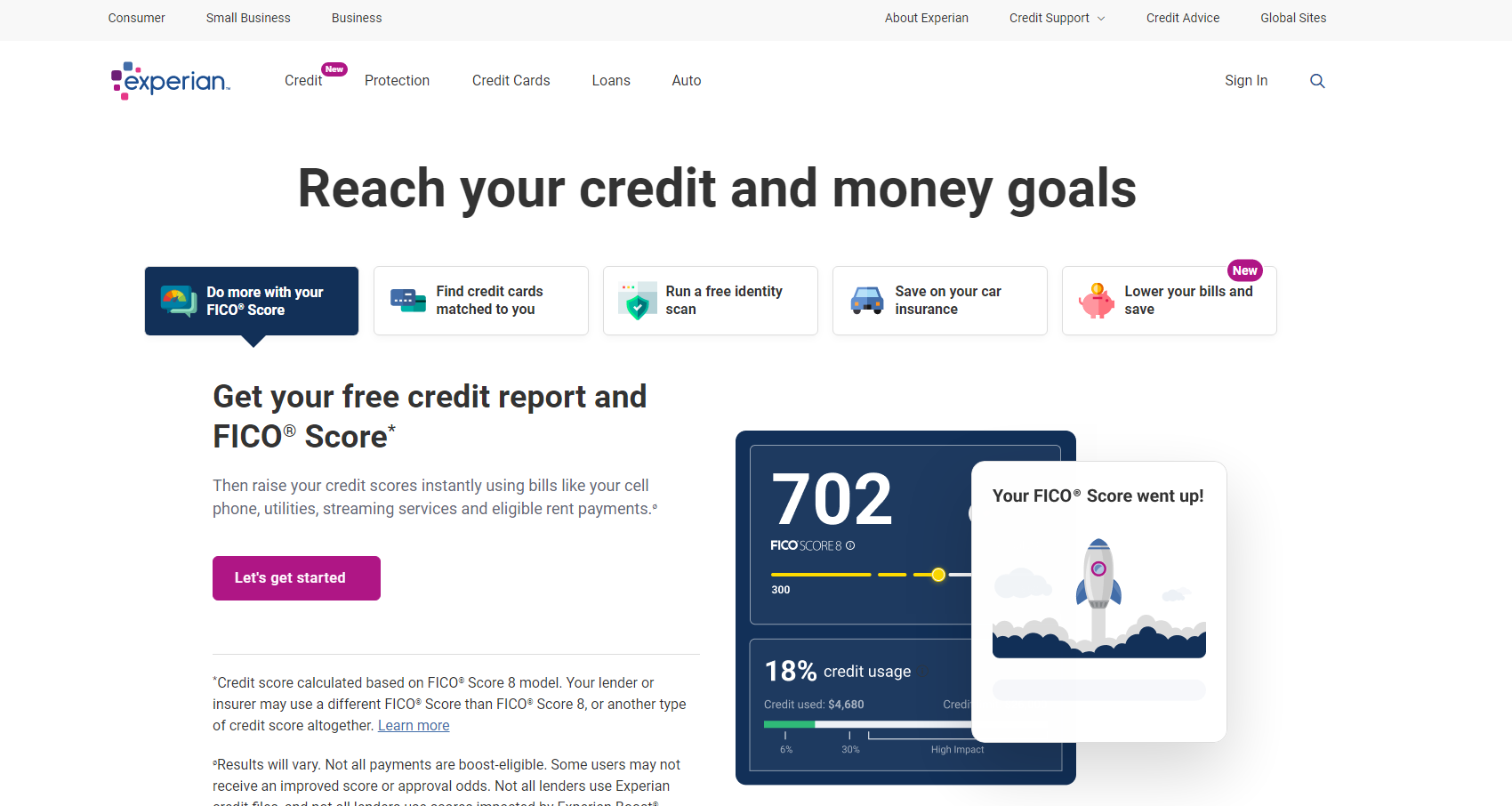

Experian

SolidQuote

US Bank Auto Loans

The Zebra

US Insurance Online

Cheap Rates Finder

Liberty Mutual

The General

Bankrate

Insurify

Big Savings Car Insurance

OUR RATINGS

Our Research Has Helped Millions of Users To Get Lowest Prices From Leading Providers.

Step 1: COMPARE

Compare the best brands side by side

Step 2: CONNECT

Work only with suppliers you choose

STEP 3: SAVE

Compare quotes to save money

.png?w=2048&q=100)

- Best For - Drivers seeking comprehensive coverage with a reliable and well-established provider

- Rating - 4.7/5

State Farm Auto Insurance is one of the most trusted names in the industry, offering a wide range of coverage options to meet the diverse needs of drivers. Whether you need basic liability insurance or more comprehensive coverage, State Farm provides customizable plans that can include collision, comprehensive, uninsured motorist, and personal injury protection. State Farm is known for its excellent customer service, with agents available nationwide to assist with claims and policy management. Their user-friendly mobile app and website make it easy for customers to manage their policies, file claims, and receive support. Additionally, State Farm offers various discounts, such as safe driver and multi-policy discounts, making it an affordable option for many drivers.

Pros

Cons

- Best For - Finding the best coverage at affordable prices

- Rating - 4.3/5

Miami-based comparison service Agile Rates links drivers in all 50 states to providers through a network of independent partners. The providers’ licensed representatives will contact customers once they fill out some basic information so they can go through their alternatives. Because Agile Rates is an internet insurance marketplace, users can easily shop for the best deal.

There are two methods by which they promote their recommended partners. Agile Rates has a certified agent get in touch with you through phone or email after you fill out some basic personal information and details about your existing automobile and insurance coverage. In addition to providing rates, Agile Rates also connect users with local service providers.

Pros

Cons

- Best For - Riders managing their finances and seeking better insurance rates

- Rating - 4.0/5

Experian offers car insurance services to customers through its partnership with the insurance broker Confused.com. Experian car insurance provides a range of driver coverage options, including third-party only, third-party fire and theft, and comprehensive policies. Customers can also choose to add optional extras such as breakdown cover, legal expenses cover, and personal accident cover to their policy.

Experian car insurance offers competitive pricing and a range of discounts to help customers save on their premiums. They also provide a 24-hour claims service to ensure that customers receive assistance when they need it most. With its partnership with Confused.com, Experian can offer a wide range of policies and options to suit the needs of different drivers.

Pros

Cons

- Best For - Streamlining the process of finding the right coverage

- Rating - 4.2/5

SolidQuote.com is a comprehensive online platform perfect for individuals who are new to buying insurance and want to compare their options. With a user-friendly interface and intuitive design, SolidQuote.com simplifies the process of exploring and selecting insurance coverage.

Through its network of trusted independent partners, SolidQuote.com connects users with licensed representatives who will reach out to provide personalized quotes based on the information provided. This allows newcomers to easily navigate their insurance alternatives and find the best deal.

SolidQuote.com goes beyond simply providing rates. They also facilitate connections with local service providers, ensuring that users have access to the support they need throughout the insurance shopping journey.

Pros

Cons

- Best For - Individuals seeking auto financing options from a reputable bank

- Rating - 4.4/5

US Bank is a preferred choice for individuals seeking auto financing options from a reputable bank. With a commitment to offering flexible and competitive auto loans, US Bank provides a range of solutions to meet your specific vehicle financing requirements.

US Bank's team of financing professionals is known for their expertise in helping customers secure the right auto loan.

Pros

Cons

- Best For - Individuals seeking streamlined and comprehensive auto insurance comparison

- Rating - 4.6/5

For those looking to navigate the complex world of auto insurance, The Zebra offers a user-friendly platform that simplifies the process of finding the right coverage. With a vast range of options and features tailored to individual needs, it stands as a top-notch choice for individuals seeking to secure reliable and suitable auto insurance.

One of the standout features of The Zebra is its ability to provide a comprehensive overview of auto insurance options. By utilizing their platform, users can efficiently compare quotes from multiple insurers, making it easier to find a policy that aligns with their coverage requirements and budget.

Pros

Cons

- Best For - Individuals seeking accessible and diverse auto insurance options

- Rating - 4.4/5

US Insurance Online offers a user-friendly platform for individuals looking to compare and secure auto insurance quotes online. Their service allows you to easily explore different insurance options, making it a convenient choice for those seeking insurance coverage for their vehicles.

US Insurance Online emerges as a reliable choice for those navigating the complexities of auto insurance. With a comprehensive range of options and resources, this platform provides an efficient and user-friendly way to find the right coverage for your vehicle.

One of the key strengths of US Insurance Online lies in its extensive network of insurers, enabling users to compare quotes from multiple providers. Their streamlined approach simplifies the process of securing auto insurance, catering to a variety of needs and preferences.

Pros

Cons

- Best For - Individuals seeking affordable and tailored auto insurance options

- Rating - 4.5/5

Cheap Rates Finder offers a reliable solution for those in search of budget-friendly and personalized auto insurance coverage. With a commitment to providing accessible options, this platform is an excellent choice for individuals looking to secure reliable protection for their vehicles without breaking the bank.

One of the standout features of Cheap Rates Finder is its ability to offer a range of coverage options from various insurers, allowing users to find policies that align with their unique needs and preferences.

Pros

Cons

- Best For - Those who want reliable car insurance with a wide range of coverage options.

- BBB Rating - A+

- Rating - 5/5

Liberty Mutual is a leading car insurance provider in the United States, offering various coverage options for drivers of all ages and experience levels. The company prides itself on its commitment to customer service and has a team of knowledgeable agents available to help customers choose the right coverage for their needs.

Liberty Mutual offers standard coverage options such as liability, collision, and comprehensive coverage, as well as additional options such as roadside assistance, rental car reimbursement, and custom parts and equipment coverage. The company also offers discounts for safe driving, multiple policies, and other factors to help customers save on their premiums. Customers can manage their policies through the company's online portal, making it easy to keep track of their coverage and payments.

Pros

Cons

- Best For - A wide range of customers, including those who may have difficulty obtaining coverage elsewhere

- Availability - Nationwide

- Rating - 5/5

The General Insurance Company is a popular American insurance provider offering a range of coverage options, including auto and home insurance. The company was founded in 1963 and is headquartered in Nashville, Tennessee.

One of the unique features of The General Insurance Company is that it specializes in providing insurance coverage to customers who have difficulty obtaining coverage elsewhere. This includes people with less-than-perfect driving records, individuals with previous insurance claims, and those who have been denied coverage.

The General Insurance Company offers a simple and streamlined application process, with customers able to receive a quote in just a few minutes. The company also provides 24/7 customer service and claims support, ensuring that customers can get the help they need when they need it.

Pros

Cons

- Best For - Customers in search of reasonable and trustworthy auto protection.

- Rating - 4.5/5

Bankrate.com is not a car insurance provider but a financial services website offering information and resources on various financial products, including car insurance. The website provides a comparison tool that allows users to compare rates and coverage from multiple car insurance providers, as well as a calculator to estimate how much car insurance coverage they may need. In addition to car insurance, Bankrate.com offers information and resources on various financial products such as mortgages, credit cards, personal loans, and savings accounts. The website aims to give users the information and tools they need to make informed financial decisions.

It is important to note that while Bankrate.com can provide helpful information on car insurance, users should still conduct their own research and due diligence before selecting a car insurance provider. Coverage options, customer service, and pricing vary significantly between insurance providers and should be carefully evaluated before deciding.

Pros

Cons

- Best For - Customers who want to compare various auto, house, and life insurers in one location.

- Services - Online insurance marketplace.

- Rating - 5/5

Insurify is an online insurance marketplace that allows users to compare and purchase auto, home, and life insurance policies from different carriers. It was founded in 2013 to simplify the insurance buying process for consumers by providing a one-stop shop for all their insurance needs.

Insurify uses advanced technology and machine learning algorithms to provide personalized recommendations and quotes to its users. Customers can compare prices, coverage options, and reviews from multiple insurance companies in real time and choose the policy that best fits their needs and budget.

Additionally, the company offers many useful tools, such as an insurance calculator, a coverage comparison feature, and a digital insurance agent that can assist customers throughout the purchasing process. The company also has a mobile app that allows customers to access their policies, make claims, and manage their coverage.

Pros

Cons

- Best For - Anyone looking for affordable, reliable car insurance coverage.

- Rating - 4.4/5

BigSavings car insurance is a popular insurance provider that offers coverage for automobiles at affordable rates. The company displays a range of coverage options, including liability coverage, collision coverage, and comprehensive coverage, to meet the needs of different customers. BigSavings also offers discounts for safe driving, multiple vehicles, and bundled insurance policies, making it a cost-effective option for car owners.

One of the standout features of BigSavings car insurance is its easy and convenient online quote system. Customers can quickly obtain a quote by entering their personal information and details about their vehicle, allowing them to compare rates and coverage options easily.

In addition to its comprehensive coverage options and affordable rates, BigSavings is known for its excellent customer service. The company has a dedicated team of agents available to answer any questions or concerns that customers may have, providing peace of mind and ensuring they get the best possible coverage.

Pros

Cons

Statefarm Auto Insurance

AgileRates

Experian

SolidQuote

US Bank Auto Loans

The Zebra

US Insurance Online

Cheap Rates Finder

Liberty Mutual

The General

Bankrate

Insurify

Big Savings Car Insurance

OUR RATINGS

Our Research Has Helped Millions of Users To Get Lowest Prices From Leading Providers.

Step 1: COMPARE

Compare the best brands side by side

Step 2: CONNECT

Work only with suppliers you choose

STEP 3: SAVE

Compare quotes to save money